Diversifying Suppliers, Vendors and Business Partners as Part of DEI Strategy

Beacon Capital Partners Case Study

June 2023

This case study is part of the W.K. Kellogg Foundation’s Expanding Equity program, which helps workplaces become more racially equitable places of opportunity. The program supports and inspires companies to take action using four pillars of racial equity strategy: Attract, Belong, Promote and Influence. Each pillar offers unique opportunities for advancing racial equity, diversity and inclusion in companies. This case study lifts up actions from the Influence pillar, which focuses on advancing racial equity through a company’s products, services or relationships externally.

Executive Summary

At Beacon Capital Partners, having a workplace that prioritizes diversity, equity and inclusion (DEI) means being intentional with choosing external partners who share those same values.

A private real estate investment firm based in Boston that has now expanded to 14 markets, Beacon Capital began its focus on DEI in 2014 and aimed to build a holistic plan that brought attention to the company’s racial equity work both internally and externally. The firm worked to reshape its selection process for business partners – also known as suppliers, vendors and service providers – at its properties by intentionally evaluating and partnering with diverse business partners.

In developing this initiative, Beacon Capital took the following actions:

- Engaged with and listened to employees, focusing on a people-first approach in understanding what they viewed as necessary in creating an equitable and inclusive workplace

- Reached out to larger firms in the real estate industry to hear about their DEI work and how they were approaching business partner diversity

- Organized an employee-led task force to pilot the initiative to expand the pool of vendors and suppliers, test it in select properties and determine if there was a measurable impact

- Gathered feedback from the pilot, appointed an official lead for the initiative and expanded it across the entire portfolio

To sustain the initiative, Beacon Capital analyzes its current diverse business partner base and determines ways the initiative can further strengthen the communities where it owns properties. This pilot has resulted in an increase in Beacon Capital’s total property spend on diverse vendors and suppliers from about 4% of controllable operating expense spending with diverse business partners in the pilot properties in 2017 to around 27% of controllable operating expense spending in 2022. Beacon Capital has integrated this tracking into its accounting system to accurately measure and track its spending on diverse business partners.

Beacon Capital shared the following key learnings that it would recommend to other companies seeking to implement a similar initiative:

- DEI is a journey – it’s okay to not have all the answers at the start

- Track data early on and identify key points of potential impact

- Support your employees that are passionate about this work through financial support and by creating time and space to enact their ideas

“At some point, you need to stop making excuses. You get tired of the excuses for lack of progress. We realized that we needed to be more persistent if we wanted to reach our desired outcome.”

Fred Seigel, president and CEO, Beacon Capital Partners

The Challenge

Beacon Capital recognized that the United States’ real estate industry as a whole is an overwhelmingly White, male-dominated business.

Beacon Capital initially looked at its recruitment practices to expand its DEI efforts. In doing so, it learned that creating a space of inclusion and belonging went beyond recruiting practices and should also include all the firm’s functional engagements. The firm works with numerous vendors and suppliers in its work and saw an opportunity to expand business partner diversity by working with firms holding Minority Women Disadvantaged Business Enterprise (MWDBE) certification and increasing its total spend on diverse vendors and suppliers at its properties. This led Beacon Capital to pilot its business partner diversity initiative.

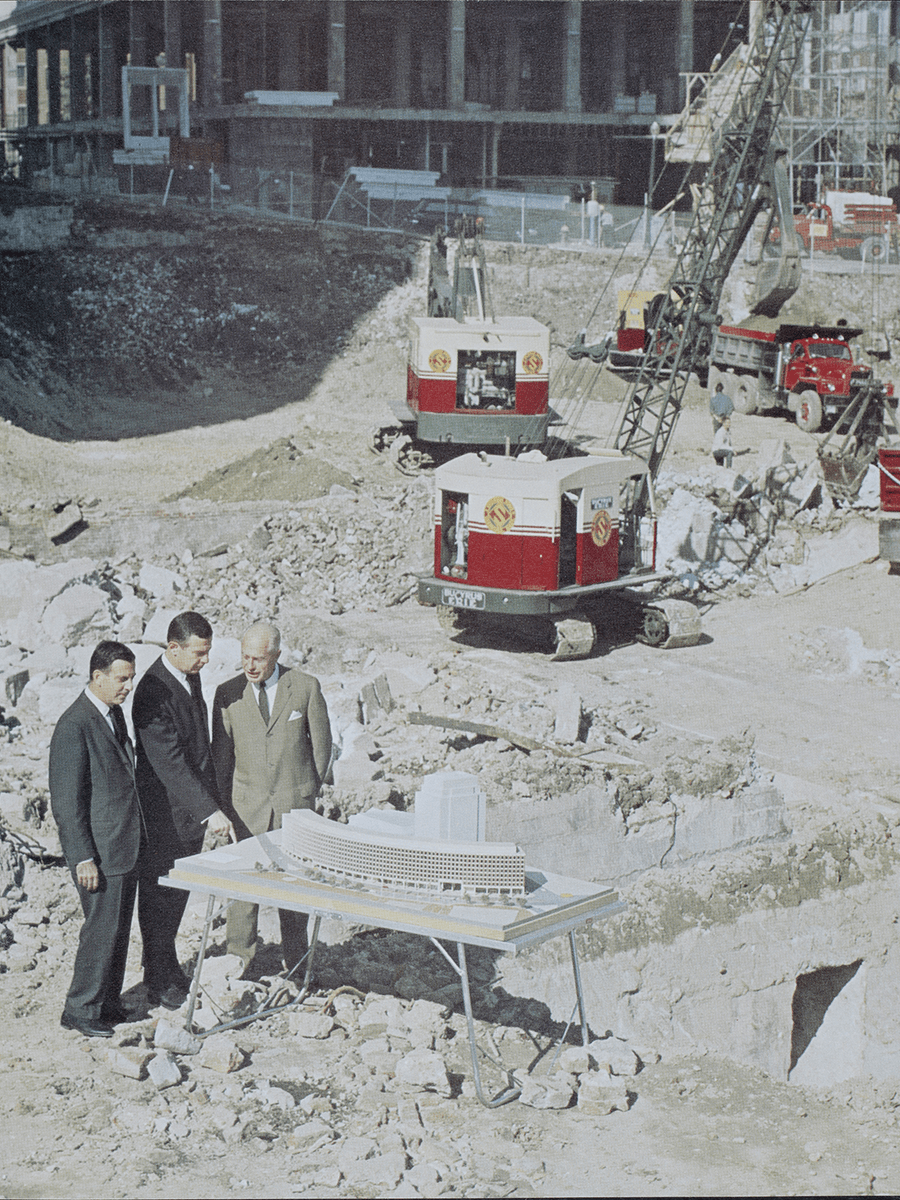

Background

The heritage of Beacon Capital’s culture is rooted in its origins as a family company. With more than a 75-year legacy of successful real estate development, management and transformation, the company originally began as a family business and values its people-first mentality. It now has a national footprint that covers 14 markets, with $14.5 billion of investment assets under management and a portfolio spanning more than 29 million square feet. While it has grown in recent years, the team has remained committed to recognizing the firm’s success through its people and by building relationships.

“Our partners are among the world’s most progressive thinkers and innovative builders,” said Fred Seigel, the president and CEO of Beacon Capital. “Every day, we come to work to make their breakthroughs possible, serving as responsible stewards for our institutional investors and leaders in our industry.”

In 2014, Beacon Capital started focusing on its DEI efforts and evaluating how it could make an impact in its sector. The firm was prepared to focus its attention on bringing a wide range of talent because it knew that a diverse team of individuals would bring a set of unique stories, perspectives and experiences that would build its organization. This was sparked by both leaders at the firm who felt personal conviction in advancing diversity and through conversations with other organizations leading DEI work at their workplaces such as the W.K. Kellogg Foundation.

Expanding gender diversity was its first goal. Its focus on bringing in women to the firm led to significant gains, with women representing 52% of the company today. Beacon Capital then turned its attention to having a racially representative firm by working with external agencies and requesting a diverse pool of candidates. After requesting feedback from schools, organizations and early external partners on what DEI work they were doing and how the firm could collaborate with them, however, Beacon Capital had challenges determining which steps would be most impactful in expanding its racial diversity.

As a result, Beacon Capital broadened the pool of schools for recruiting beyond the Ivy League on the East Coast by adding local universities like the University of Massachusetts and Boston College. It also established partnerships with the Toigo Foundation through an introduction by the W.K. Kellogg Foundation, in addition to SEO and the Urban Land Institute (ULI) Commercial Real Estate Success Training (CREST) program.

Building on that foundational work, the firm aspired to put a broader premium on DEI, ensuring that it was pursuing its DEI efforts across the firm’s engagements. This inspired the idea of Beacon Capital’s business partner diversity initiative.

How Beacon Capital Built and Piloted a Business Partner Diversity Initiative

When Beacon Capital was looking to launch its business partner diversity initiative in 2017, it had approximately 100 employees. The overall business was continuing to grow, acquiring and investing in real estate in major cities across the U.S. The real estate industry as a whole, however, did not have a pressing focus on DEI. The firm realized that it had to separate what it did as a company from its role in the industry by moving away from conventional practices within the industry and taking initiative with its own unique approach to achieve its DEI goals.

Beacon Capital began its assessment by having internal conversations with leaders and members of the asset management teams about the impact and influence it desired to have. These conversations, aided by discussions with Expanding Equity participants and the W.K. Kellogg Foundation, revealed candid and thoughtful feedback from employees, emphasizing their own experiences and offering personal aspirations.

A crucial question stuck with the leadership team at the time regarding how the company’s money would be spent: “Do the teams at our properties reflect the communities in which they are based?” The answer was “no,” leading to a pivotal moment where Beacon Capital knew that the organization’s DEI work needed to expand.

From there, Beacon Capital assessed the current state of the company and reached out to its partners – public third-party global property management firms – to learn what they did to advance DEI and racial equity at their organizations.

Beacon Capital met with a global real estate services company, which sent its DEI team to Boston where the two organizations were able to exchange ideas on how they wanted to work with vendors and suppliers that had representation at all levels of the company.

Seigel recounted, “We collaborated on the big questions based on our internal conversations with our initial assessment, such as ‘how do we make sure that when we hire you, our teams reflect the community?’”

Beacon Capital wanted to see how it could utilize its influence in the market through its vendor and supplier spending. With more than 29 million square feet of real estate and a substantial amount of spend on goods and services at those properties, the company knew that it could create a real impact by initiating a thoughtful business partner selection process. Its previous business partner selection did not consider factors such as MWDBE certification, and the firm saw an opportunity for change by actively seeking out a broad set of vendors and suppliers in addition to MWDBE as a consideration.

“Everyone [on Beacon Capital’s leadership team and employees] bought into the idea that this overall commitment as an organization is important, and we could really have a meaningful impact on the communities where we do business,” said Seigel. “We have a large footprint in our community, and there is a lot of room to have a large impact in seeking representation among who we work with.”

Beacon Capital knew that the implementation of this vision would be challenging to enact at scale. Some employees also raised concerns about the new process changes.

“Everyone had a really open mind about it, but there will always be a little bit of hesitation with something so new,” recalled Seigel. “Not resistance, but rather uncertainty, such as ‘who’s going to run it? Where’s the accountability flow to? Are you just piling more work on me?’”

Beacon Capital is proud to have a strong pilot culture, meaning when someone has an idea, they are willing to test it out. Piloting gave the firm opportunities to address questions head-on, to identify what business partner diversity would look like and think about how to scale the initiative.

“What piloting did for us organizationally was make it an easy way for us to start a collaborative, organic conversation rather than having it be a project solely led by senior management,” said Seigel. “It became a multi-step plan of ‘here is an idea, and we think we could build upon this. What are some of the things we need to consider?’”

The firm then identified its concerns, with the biggest ones being the depth of local vendors, its capacity to take on new contracts, and ensuring consistency with the quality of past products and services. Beacon Capital’s overall goal and standard has always been to provide a high level of service to the people that occupy its buildings, and the organization sought to ensure that remained true.

Once Beacon Capital established that it was going to move forward with the pilot, it organized a task force of various individuals including Seigel, team members from the accounting department, regional and local asset managers, and more to test the initiative. The firm also set up discrete measures such as MWDBE spending and recorded and tracked these measures by incorporating them with vendor data in Beacon Capital’s accounting system.

To implement the business partner diversity initiative, Beacon Capital:

1. Determined policy updates needed to formally vet business partners

The business originally used to bid out staffing services such as janitorial services, building security and other service providers and vendors. With the business partner diversity initiative, Beacon Capital changed its policy so that one of the initial criteria when selecting business partners was to understand not only the company’s values but to also evaluate the diversity of the vendors and suppliers’ staff and ownership.

This entailed two components:

- Looking at whether the intended building staffing for property management – typically from larger firms – was diverse or representative of the local community

- Whether vendors and suppliers were MWDBEs

2. Piloted the initiative

The task force came together and began the pilot project to see if it would realize impactful results through the proposed business partner diversity initiative.

“While I’d love to tell you that the decision to begin the pilot project was extraordinarily qualitative and quantitative, it wasn’t,” recalled Seigel. “We are just big believers in pilot projects and knew it was important to our company to at least try this plan through a trial.”

To begin, Beacon Capital first gained a consensus on the number of properties to pilot and which ones to include for the initiative. The firm sought pilot properties of varied profiles. The goal was to grow this initiative across several properties, so Beacon Capital ultimately decided to launch the pilot on three different properties in three different markets to gather enough information on what was working and where there were challenges, with the anticipation of rolling the initiative out to more properties.

“We did the pilot project and we got exceptional buy-in both internally and from vendors and suppliers,” said Seigel.

3. Appointed a lead and expanded the initiative across the entire portfolio

The pilot began as a group effort, with asset managers leading it and communicating both their challenges and best practices with each other. The managers would then present their progress and feedback during quarterly reviews.

Once the initial pilot was complete on the three properties, more leaders became comfortable and acclimated with solidifying the initiative. The pilot was intended to gather data and validate whether the firm could influence diversity through this initiative. The team was then able to focus on the details and execution of the initiative to determine if there was a measurable impact.

Leaders of the initiative started to further their aspirations into how they could provide a higher level of service to tenants. One member of the team, Shane McLaughlin, became particularly interested in what could be done to have a broader community impact. McLaughlin now leads the initiative and tracks its progress, working directly with asset managers and creating annual goals across the properties.

The initiative was then ready to be expanded across the entire portfolio. Beacon Capital expanded it by collecting and tracking MWDBE status for each vendor and then using that data to generate reporting for the operating expense spending at each property.

4. Hired a consultant to broaden the reach and certification of business partners

To continue to improve and advance the initiative, Beacon Capital brought on a consultant to broaden its reach by compiling public information and helping to confirm certified vendors and suppliers. The company recognized that it may not be familiar with many business partners that offer diverse talent, so bringing in an expert helped the firm to connect with new vendors and suppliers and to assist them in their MWDBE certification.

In collaboration with data platform Supplier.io, Beacon Capital has been working on a comprehensive business diversity dashboard. This platform will provide an in-depth view of the firm’s total expenditures across its portfolio, encompassing a vast array of enriched data. The expanded analysis will not only cover controllable operating expenses but also incorporate property-level spending including capital projects, tenant improvements and owner expenses. Furthermore, the dashboard will offer sorting features to categorize diverse groups within the portfolio and establish new benchmarking objectives.

The platform will also integrate tracking that will extend Beacon Capital’s program beyond primary vendors and encourage them to monitor their own expenditures while offering opportunities to emerging vendors. With its extensive database of diverse vendors and suppliers, the platform can be filtered to identify vendors that fulfill the firm’s criteria, thereby assisting property management teams in discovering new diverse businesses.

Beacon Capital is also partnering with its consultant to evaluate the business partner diversity initiative and develop a community impact report. This assessment will quantify the extent to which the initiative has supported the community by fostering opportunities for new businesses and generating employment.

Beacon Capital plans to sustain the business partner diversity initiative through the following actions:

- Expanding the initiative to contractors: While Beacon Capital initially started the business partner diversity initiative to focus on the buying of goods and services, it is now expanding to contractors for new construction and large capital projects. Many cities have set standards in terms of minority contractors/contractors of color and diversity goals for ground-up development, however, standards for work completed inside of existing buildings are not as prescriptive. This expansion will follow the same process of collecting MWDBE certification status and determining an efficient way to track, consolidate and report the data.

- Offering rewards and recognition: With the goal of expanding the firm’s use of diverse business partners, Beacon Capital’s next task is to think through incentives or recognition for the business to continue the momentum. While the company is not structured in a way to provide commissions, it plans to investigate ways to reward and recognize the property management teams for their contributions to expanding business partner diversity.

- Understanding the current diverse vendor and supplier base and ways it can help: Beacon Capital feels fortunate that it can conduct business in the cities it works in, but business depends on the ability of vendors and suppliers to attract and retain diverse talent. Because of this, forging a stronger connection with the communities Beacon Capital is investing in is another goal it would like to build upon. The firm is intentionally broadening the set of potential partners to include more diverse groups, contracting with and offering growth opportunities to MDWBE firms. “We don’t have the experience yet to really know what we could be doing to help those business partners grow, but we’re willing to learn and support,” explained Seigel. “If we find out what their impediments are to growing, we can learn from that and help them go through the certification process.”

- Measuring impact and progress: Beacon Capital is working to ensure the initiative becomes part of the system by measuring, tracking and providing progress updates and integrating discussion as part of regular asset reviews with the broader firm.

"The potential for this initiative is very exciting.”

Fred Seigel, president and CEO of Beacon Capital Partners

How the Expanding Equity Program Supported Beacon Capital Partners

Advancing DEI was important to Beacon Capital professionally and personally, but the firm needed help to actualize its goals.

“We wouldn’t be where we are today without them [Expanding Equity],” said Seigel. “The leads at Expanding Equity offered structure and expertise on racial equity work, which was a huge benefit to smaller companies such as ourselves. This really instilled and enforced discipline to pursue our DEI goals.”

Beacon Capital was also influenced by eye-opening data and statistics shared by the Expanding Equity program on the dramatic fall off of staff of color advancing to leadership, specifically on the funnel of entry-level positions to leadership positions. These statistics motivated the firm to act.

Diverse Spend as a % of Controllable Operating Expenses

No Data Found

Results/Progress-to-date

Beacon Capital has seen a significant increase in diverse business partners across its properties since the implementation of the initiative. In the program’s first year in 2018, the initiative reached 7% of total property spending with diverse vendors and suppliers. In 2021, that number increased to 12% of diverse total property spending. Benefitting from its work over time, as well as improving supplier data through supplier.io, Beacon Capital finished the 2022 year of its total controllable operating expenses with diverse business partners at 27%.

This initiative has also been beneficial for investors, with Beacon Capital growing and diversifying its vendor and supplier base and creating increased competition for business. The firm has always set a high standard for service and has maintained that while also increasing its diverse spending. This competition has led to better services for the firm.

Beacon Capital’s 2023 target for its properties’ total spend towards diverse vendors and suppliers is 30%. The firm is confident that it will continue to learn from its properties and continue to improve and expand the initiative across its properties.

Key Learnings

Reflecting on the business partner diversity initiative’s journey, Beacon Capital shared the following reflections and learning from its experience:

1. DEI is a journey – it’s okay to not have all the answers right off the bat

Beacon Capital reflected on how starting a DEI journey can be challenging to not know where to start or which resources to go to initially. They shared that it would like other companies to know that it’s okay to not know all the answers immediately.

“We certainly still do not have all the answers, and we certainly do not have all the resources,” said Seigel. “There’s no need to initially discuss all the small details [of how everything is going to work] at the start. It really is a journey.”

“You can measure, and you can benchmark, but at the end of the day, the learning process sometimes isn’t something tangible. So, start small and build your journey into stages.”

2. Establish a tracking system early on that allows you to identify key points of potential impact

Beacon Capital shared that determining a tracking system at the start of the process was essential in the success of its business partner diversity initiative. By integrating its tracking of diverse business partner spending into the firm’s accounting system, Beacon Capital was able to benchmarks to establish its goals early in the process and measure its growth since beginning the pilot.

3. Support your employees that are passionate about this work by encouraging them to pilot their ideas

While it can be inviting to immediately hire outside experts, Beacon Capital shared that focusing on creating an internal task force that was passionate about the initiative led to a more organized, cohesive and devoted core group driving this work. Giving employees autonomy of the pilot and having the leadership back them through moral and financial support allowed the firm to turn an idea into a formal initiative in expanding its supplier and vendor diversity.

“I’m not dismissing what it can cost in organizational time, but if you focus on the people who are committed to the work you’re doing, they often become more than willing to find the time,” explained Seigel. “Programs like this start with people, so find the right people and be willing to be patient while you learn from and grow with each other.”

Explore More Expanding Equity Content

Linking ideas, tools and knowledge to action

DEI expert: Be proactive, not reactive

Implementing HR policies and practices that center and advance racial equity, diversity and inclusion: New toolkit shares WKKF’s “how”

Actions for racial equity in the investment management industry

Using a skills-based hiring approach as part of a DEI strategy

DEI and the frontline worker experience

Ripples of Change: Ralph de Chabert’s racial equity, diversity and inclusion journey

Advancing DE&I representation goals through formal incentives

Inclusion & Belonging: Actions toward racial equity

Comments