Latino Community Credit Union, together with the Latino Community Development Center, is a finalist for the Racial Equity 2030 Challenge, a global call to advance racial equity in the next decade. They’re integrating financial inclusion, wealth-building and cultural empowerment to ensure Latinos can buy a home and feel at home in the U.S. Southeast.

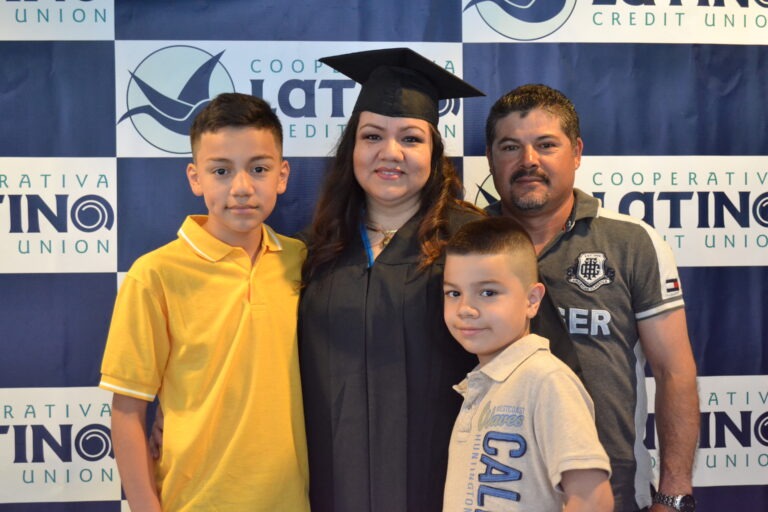

When the Mozqueda family moved from Mexico to Greensboro, North Carolina in 2004, one of the first things they had to do was buy and outfit a van for their daughter who is differently abled. The required upgrades would cost more than what the van was worth.

The Mozquedas needed to secure a loan but lacked an established credit history. Like many before them, they ran up against a financial system structured in a way that limits economic opportunity for immigrants seeking to build a life in the United States.

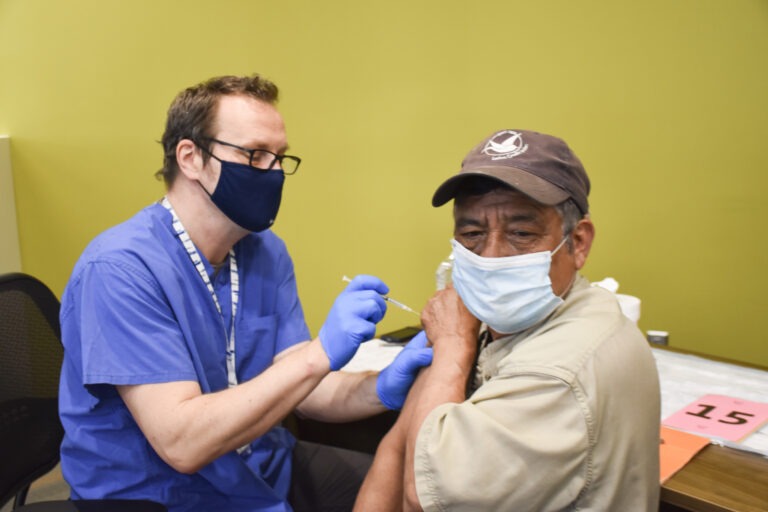

The North Carolina-based Latino Community Credit Union (LCCU) was ready to help. As a bilingual, Latino-led credit union, LCCU is uniquely set up to help Latinos and other immigrants navigate the U.S. financial system, invest in their talent and achieve their dreams.

“In Latin American countries, often the fewer loans you have, the better,” says Gabriel Treves-Kagan, Senior Director of Investor Relations at LCCU. “But in the U.S., the financial system is completely different.” LCCU understands the unique needs and perspectives of new immigrants. For families new to the financial mainstream, like the Mozquedas in 2004, LCCU accepts “alternative” credit histories when lending, such as proof of rent payments and utility bills. Treves-Kagan says LCCU’s 99.8% repayment rate makes one thing clear – investing in the talent and dreams of immigrants is the right thing to do and sound business.

For the Mozquedas, what started with a van loan grew into a trusting relationship with LCCU that put them on the first rung of economic opportunity and wealth building – resulting in financing for their business, a house mortgage, and led to scholarships for their eldest daughter to pursue a nursing degree.

Today, Latinos are the youngest and fastest-growing demographic in the Southeast and the second fastest-growing nationwide. At this critical time, LCCU is committed to ensuring that Latinos moving to the Southeast have an equitable chance to create both a home and a sense of belonging.

According to LCCU CEO and President Luis Pastor, Latinos in the Southeast are caught in what he calls the Latino Opportunity Gap – a situation caused by a structurally racist system that limits Latinos’ ability to access economic opportunity and build the social and cultural capital they need to buy a home and feel at home.

“Home creation is a way to create wealth for your family and put roots in your new community,” says Pastor. “Owning a home is the most powerful way to create equity and community.”

As a finalist in the W.K. Kellogg Foundation’s Racial Equity 2030 challenge, LCCU will narrow the Latino Opportunity Gap by expanding its Southeast regional operation to help thousands of Latinos in Georgia, South Carolina and Virginia buy homes and build generational wealth. It will also develop programs and a cultural center to provide opportunities for Latinos to connect, celebrate their diverse cultures, and develop the skills and tools they need to build strong economic, cultural and social networks.

The Situation

More than half of the 60.6 million Latinos in the United States live in Texas, California and Florida. But that is changing as more first and second-generation Latinos move to the Southeast. According to the National Association of Hispanic Real Estate Professionals, Durham-Chapel Hill, NC, is the fastest growing Latino homeownership area (49.2% growth rate) in the country.

While a recent Urban Institute study projects that Latinos will account for 70% of all new homebuyers by 2040, many will face significant barriers built into the U.S. mainstream financial system that make it difficult to obtain conventional loans at equitable rates.

In 2020, Latinos held just 10.7% of conventional loans. Many Latinos:

- Do not have the credit history that traditional banks require

- Earn 20% less than non-Hispanic Whites; 43% are unbanked or underbanked at twice the rate of non-Hispanic Whites

- Choose Federal Housing Administration (FHA) loans that require lower down payments, but can be more expensive in the long run

- Paid an average of 90.1% more in closing costs for an FHA loan versus a conventional loan in 2020. They also paid more than their White counterparts in closing costs for both FHA and conventional loans

LCCU aims to remove those roadblocks by radically changing the lending process for the thousands of Latinos who are traditionally locked out of economic opportunity.

“If you are renting then you are not creating wealth for your family,” says Pastor. “Everyone deserves a place to feel at home. A home is a family investment – a place where you can start bringing your own tradition, your own culture.”

LCCU is one of the largest Latino-led credit unions in the country and a nationally recognized leader in the field of financial inclusion and immigrant empowerment. Three of every four LCCU mortgage borrowers are purchasing their very first home and 98% are Latinos.

Game-Changing Solution

LCCU will work on two fronts to eliminate the Latino Opportunity Gap: expand its regional mortgage program for wealth building and develop ways for Latino communities to build strong economic, cultural and social networks.

By 2030, LCCU will expand its mortgage program to help more than 3,000 families in North Carolina, South Carolina, Georgia and Virginia buy a home and begin to build generational wealth.

To make sure Latinos can feel at home where they buy a home, LCCU will focus on creating community, strength and belonging. From California to Florida, generations of Latinos have developed economic, social, cultural and political networks to influence the day-to-day norms and policies in their own communities. In the Southeast, the Latino population is growing but does not yet have similar networks.

To grow those networks, LCCU will:

- Launch the Southeast’s First, Free-Standing Latino Cultural Center to celebrate and share Latinos’ diverse cultures and build the strong social and cultural networks that support their ability participate fully and engage civically in our communities. The Cultural Center will host events and deliver year-round, culturally-affirming programming as well as establish a replicable regional model.

- Create the Experiencia Latino Equity Training to help Latinos and their neighbors develop a more nuanced understanding of the Latino experience. By engaging key local stakeholders through these trainings, it will help create local norms around spending time and resources that will advance the Latino equity conversation in local governments, schools, business, social movements and congregations.

- Elevate Latino-led Community Philanthropy through the creation of dozens of giving circles that will galvanize the Latino community to better leverage its full assets, support local initiatives, and foster a new generation of Latino civic leaders.

Reality vs Perception

Treves-Kagan wants his fellow Latinos to no longer feel minimized. He wants different generations to understand each other. And he doesn’t want to wait decades for that to happen.

“As a Latino dad, there’s nothing I want more than my girls to speak Spanish and to feel proud and understand their culture, their grandparents, me” says Treves-Kagan.

Underpinning LCCU’s work is the desire for Latinos to understand that “here you are not less, you are the same.” That is why LCCU provides equitable access to economic opportunity, offering quality loans to those with alternative forms of credit and the same fair and ethical loan rates to everyone. “We are the people we serve,” says Pastor. “We become part of their family, and they become part of ours.”

When Mozqueda’s oldest daughter, Ingrid, graduated from Trinity Washington University with her nursing degree, the family invited the LCCU team to the celebration.

“Can you imagine inviting a mainstream financial bank to your graduation?” laughs Pastor. “They invited us.”

Related Links

Mobilizing 50,000 Indigenous women for change

Caretakers of the Earth: An Indigenous-led movement to secure land rights

Healing through action

Regenerating food and agricultural finance systems in Indian Country

Restaurant workers are standing up for increased wages – and racial and gender equity

Native Hawaiian-centered approach helps youth heal and become healers

In Brazil, a movement to unleash the world’s first anti-racist education system

Comments