The W.K. Kellogg Foundation has convened a cohort of influential investors (endowments, investment banks, corporations and individuals) for an experience called Reimagining Opportunities for Investment (ROI) in the South, an exploration of diverse investment opportunities in the U.S. South. This dynamic group of investors is coming together to mobilize a sustainable investment ecosystem for Black, Indigenous, Latino and other undercapitalized communities of color in the American South.

The South is the fastest-growing region in the U.S., and increasingly more political and economic power is shifting to Southern states. Yet the region is one of the most overlooked opportunities for investment, especially areas in the Deep South like Arkansas, Alabama, Mississippi and Louisiana. The W.K. Kellogg Foundation (WKKF) has been working in the region for decades, funding community and economic growth with a focus on eliminating racial wealth and opportunity gaps.

COVID-19 brought to light deep disparities for communities and people of color, especially in the U.S. South. These stark inequities have been decades in the making, but promising shifts are happening, including the return of middle-class consumers of color, reinvigorating Southern communities through a combination of economic and civic power.

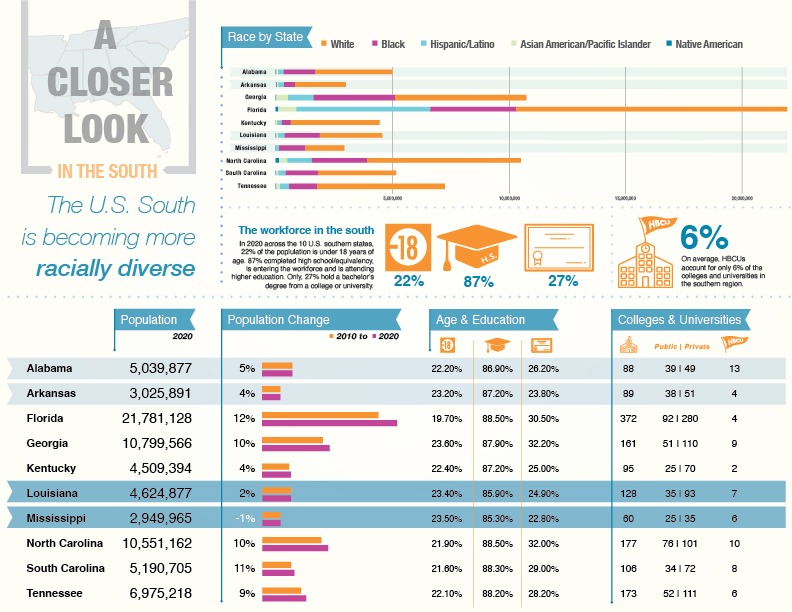

Since 2020, more than $50 billion in corporate pledges were made to advance racial equity. Investing in the South is one of the greatest opportunities for impact with a racial equity lens because of the concentration of people of color. Most of the U.S. Black population lives in the South. The Latino population in the South continues to grow, accounting for more than half of the Latino population growth since 2010. Asian Americans also have a growing presence in the region.

The Kellogg Foundation designed this virtual investments tour, Reimagining Opportunities for Investment (ROI) in the South, to illustrate how converging economic and social trends are creating opportunities for impact-oriented investors across asset classes. ROI in the South includes deep dives on a few key sectors and geographies to convey important lessons for how to approach investing in the region. Investing in ways that benefit, rather than exploit, communities requires a willingness to learn about the place and to ground approaches in local relationships and solutions.

A Unique and Complex Region

ROI in the South kicked off in May 2022 with an overview of the historic economic and cultural trends that shape the South as an investing market. Dr. William Spriggs, Howard University professor and chief economist at the AFL-CIO, spoke with Cynthia Muller, WKKF’s director of Mission Driven Investment (MDI), about how global, national and regional patterns are impacting the South’s communities and economies.

“Coming out of this [pandemic] we truly are on the path to two very different economies, ‘two very different countries [as it relates to the South].’”

Dr. William Spriggs, Howard University professor and chief economist at the AFL-CIO Tweet

Much of the South’s culture and economy has been shaped by slavery, the Civil War, Jim Crow-era laws and various forms of economic exploitation. Like the rest of the country, the South has experienced the effects of more recent events: the war in Ukraine, COVID-19 and upheavals in the global economy. In addition, Spriggs pointed out that decisions made by state governments in the South – such as refusing billions in federal aid and cutting unemployment insurance – mean inequity has been even more deeply seated in the region than in other parts of the country. For example, though 21 states raised the minimum wage in January 2022, a majority of states in the South still use the $7.25 federally mandated minimum wage. Considering the majority of the country’s Black workforce resides in the South, this also means further entrenching racial inequity.

“Almost uniformly the states that do not have a minimum wage above $7.25 are in the South. So, while the rest of the nation is on a path where those on the bottom are experiencing wage growth, not the people in the South.”

Dr. Spriggs Tweet

As Cynthia Muller noted, history is repeating in the South. ROI in the South aims to illuminate how investors can learn the lessons of the past and take a different approach to create a vibrant, equitable economic future.

The Business and Investment Case

There are many factors that make the South compelling from a business and investment point of view. The cost of doing business is low due to inexpensive labor, real estate and land. Yet these factors also mean people and resources in the South are vulnerable to extractive models that take advantage of low costs but siphon wealth out of the region and its communities.

Innovative investors can benefit from the low costs of doing business while also driving meaningful investment that promotes racial equity in the region. WKKF believes the South is primed for anchor investors who can build an investment ecosystem and create opportunity. Investors can generate financial returns that result in wealth going into communities and promote racial equity.

Investment Case Studies

To illustrate how investors can approach opportunities that are grounded in local knowledge and drive wealth into communities, the foundation’s Mission Driven Investment (MDI) team highlighted two examples of investments they have made in the region:

Southern Bancorp

This community development financial institution (CDFI) provides accessible business and personal financing in Southern communities that have been overlooked by traditional financial institutions. Lack of access to affordable, non-predatory capital is one of the biggest barriers facing individuals and small businesses in the South. That gap is even more pronounced in majority-Black communities, resulting in growing racial inequity. As part of the process of making the investment, WKKF’s MDI team worked closely with the bank’s team to understand what kind of capital would enable them to better serve low-income communities during the 2009 financial crisis. The foundation made an equity investment that Southern Bancorp Bank was able to leverage, growing its assets by more than $30 million and expanding to additional underserved communities.

Trident American Dreams Fund

This buyout private equity fund aims to provide growth-oriented companies in underdeveloped markets with capital and post-investment support. WKKF identified it as a strong opportunity because it is filling a market gap and has a proactive focus on impact and racial equity. American Dreams serves lower-middle-market companies, a market segment currently underserved by private equity. It has a strong commitment to social impact both in its operations and in how it supports portfolio companies. Trident is led by a Black fund manager, and most of its employees are people of color. The fund supports portfolio companies in integrating ESG and DEI practices into their own operations and has set a goal of ensuring at least 13% of its value creation accrues to majority-Black communities.

Looking Ahead

Future ROI in the South sessions dive into specific sectors and geographies, including reentry and agricultural investments, and virtual stops in Mississippi and New Orleans. WKKF believes the following are helpful to keep in mind as investors think about opportunities in the South:

- There is tremendous opportunity and momentum in the South – it is just waiting for the right structures, capital and partners to demonstrate how to engender equitable progress alongside returns.

- There has long been a tendency to look at the South as a place of deficiency. Flipping that to an asset frame is a powerful way of attracting more – and better – capital. It becomes a new lens for investors to think differently about opportunity, value and risk.

- Investors who want to make an impact in the South need to match capital to needs – not the other way around. That requires understanding the dynamics of the enterprises, funds and communities in question.

- Those who are embedded in communities know best what works for them and are the most capable of designing solutions. Investors will be better able to discover and assess opportunities if they listen and partner with those on the ground and invest in the vision people have for themselves.

- Investing in the South is about two things – seeing opportunities and creating longer-term partnerships to build an ecosystem that is sustainable and benefits communities long-term.

Related Links

- The Business Case for Racial Equity Report, W.K. Kellogg Foundation

- Using the capital markets to close the racial wealth gap, W.K. Kellogg Foundation

- Listen to a Kellogg Foundation curated Spotify playlist of music from the American South

Comments