The W.K. Kellogg Foundation (WKKF) has convened a cohort of influential investors (endowments, investment banks, corporations and individuals) for an experience called Reimagining Opportunities for Investment (ROI) in the South, an exploration of diverse investment opportunities in the U.S. South. This dynamic group of investors is coming together to mobilize a sustainable investment ecosystem for Black, Indigenous, Latino and other undercapitalized communities of color in the American South.

Following our feature looking at the region as a whole, opportunities in Mississippi and New Orleans, opportunities in the agriculture sector, and opportunities to invest in reentry for formerly incarcerated individuals. This story takes a step back and asks the question: how do we “rewire” investors to get to “yes” on investing in the U.S. South?

ROI in the South has highlighted the many factors that are making the U.S. South a strong market for investors who want to spur economic growth and address racial equity in communities throughout the region. Social and economic trends, such as rapid population growth due to reverse migration and the availability of a diverse labor pool, make it an appealing market for many kinds of businesses and investors. Geographies such as New Orleans and sectors such as agriculture are teeming with opportunities to nurture the region’s human and natural resources in ways that build sustainable wealth for its communities, particularly communities of color.

Yet even in the context of these positive trends, getting to “yes” can require deeper shifts in mindsets and practices. A sustained commitment to investing in the South can mean overcoming barriers both seen and unseen. Over the course of the series, participants from various institutions and backgrounds raised the fact that the South tends to be associated with a deficit frame, rooted in the history and aftereffects of colonialism, slavery and economic exploitation. Changing that to an opportunity frame is a journey that requires addressing biases and long-entrenched narratives alongside making data-driven decisions.

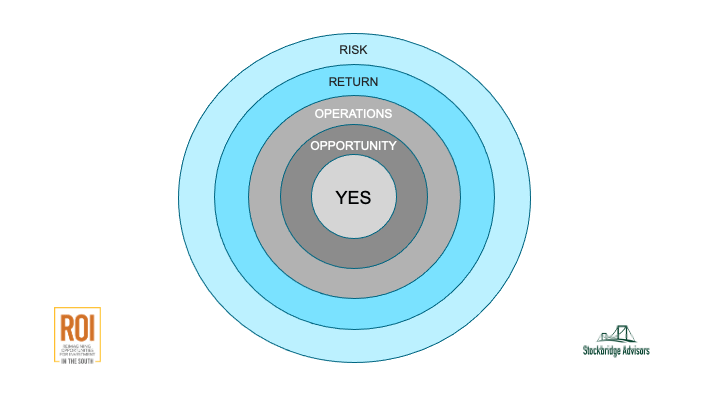

The WKKF Mission Driven Investment (MDI) team collaborated with Stockbridge Advisors to develop a framework called “Rewiring for Yes.”

The framework is designed to help institutions get to yes, on organizational goals, initiatives and operational challenges by shifting perspectives. “New” or “different than” approaches often encounter unintentional, but entrenched, internal resistance. “Rewiring for Yes” puts “Getting to Yes” at the center of the decision-making process, while guiding users through four fundamental components of the due diligence process: risk, return, operations and opportunity. Over the past five years, 91% of WKKF MDI portfolio investments have gone to communities of color and more than 60% to diverse managers and owners. The team shared that a critical component of this was building on the knowledge and deep relationships formed through the foundation’s decades of programmatic work in the South. The conversation included perspectives from three investors for whom seeing the South as an opportunity is embedded in their core approach:

Investment Case Studies

Valor Ventures: Valor, which is headquartered in Atlanta, makes seed-lead stage investments in B2B software startups across the South, primarily in enterprises led by women and people of color. The South is the region least served by local venture capital, and Valor’s founder, Lisa Calhoun, saw an opportunity to change that by creating infrastructure to bring together investors and entrepreneurs. From Valor’s point of view, diversity and inclusion are not a nice-to-have – rather, this lens serves as a corrective to entrenched biases in finance, enabling them to see the full spectrum of high-potential founders and market opportunities.

Trident: Trident is a private equity firm that invests in small businesses in untapped sectors that attract only 0.6% of private equity capital. While Trident invests nationally, it focuses on overlooked communities and individuals, including multiple investments in the U.S. South. It works with a network of Independent Sponsors and Operating Sponsors (ISOPS) to find opportunities, and supports portfolio companies in various ways, including diversity, equity, and inclusion (DEI) practices to amplify value creation. This approach has led to both strong returns for investors and significant growth for Black employees and communities.

Apis & Heritage Capital Partners (A&H): A&H is a private equity firm that aims to close the racial wealth gap via increasing employee ownership of businesses. A major component of the racial wealth gap is the retirement gap: 60% of Black and Latinx people have $0 in retirement accounts. A&H targets companies with large workforces of color and helps them transition to employee ownership via multiple approaches. Part of its approach is to work with employees to build buy-in and a sense of shared ownership, which it believes leads to strong culture, satisfaction and performance: 0.2% of employee-owned businesses default on loans.

Looking Ahead

WKKF will continue to build its portfolio of investments in the South and to support peers in getting to “yes” on exploring and committing to opportunities in the region. The following lessons and insights can be helpful to investors.

- Different types of institutions should consider that there is power in being able to leverage multiple tools. Endowments, PRIs, grants and other types of support all help investees start up and scale – especially in regions that lack market infrastructure.

- Partnerships with organizations on the ground are critical to making good investments. Organizations that understand the dynamics of communities provide critical perspectives on what kinds of solutions work – and what kinds of interventions risk replicating dynamics of disenfranchisement or exploitation. They can also connect investors to opportunities that are hard to find in less developed markets.

- Post-investment support can provide tremendous value-add. WKKF’s MDI team has found that supporting managers, especially inexperienced managers, on strategic communications, networking and other types of capacity-building enables them to grow and thrive.

Related Links

- The U.S. South is on track to becoming one of the best for regional value in seed venture capital in the United States, according to research from Valor Ventures.

- Read Trident’s Doing Well While Doing Good report that highlights how the firm advocates for diversity end-to-end with a belief that change starts from within.

- Watch this SOCAP22 panel conversation on supporting BIPOC-Led businesses at every stage featuring WKKF partners and investees: Apis & Heritage Capital Partners, BlackRock’s BIO Fund, CapEQ and Founders First Capital Partners.

- Read the recently released Industry Actions for Racial Equity – Investment Management. This WKKF produced workplace transformation guide considers the state of racial equity, diversity and inclusion (REDI) for the investment management industry and shares insights, actions, common pitfalls and examples from leading organizations that are part of the Expanding Equity program network.

Comments