Northern Initiatives is an innovative Community Development Financial Institution (CDFI) working to support small business owners and build sustainable and equitable economies across Michigan.

By providing business funding to entrepreneurs who don’t qualify for traditional financing – many of whom come from underserved populations – Northern Initiatives’ partnerships have helped spur local economies and assist small businesses to create much-needed jobs across the state.

Since its inception, the CDFI has helped create more than 6,000 jobs by supporting more than 1,300 loans to small businesses in Michigan. In addition to business loans, the Michigan CDFI provides microloans, healthy food access loans, and complementary business services such as coaching and mentoring to the area’s communities.

Partnering To Help More People Thrive

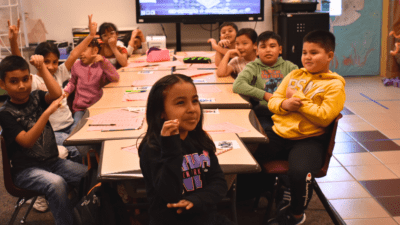

Through partnerships with businesses and foundations, Northern Initiatives has been able to invest in emerging entrepreneurs, women- and person of color-owned startups, and food-based businesses, including more businesses owned by Latino people, the state’s fastest-growing community.

In 2018, with the help of a $2 million program-related investment (PRI) from the W.K. Kellogg Foundation’s impact investing portfolio, the lender was able to make capital even more affordable for 12 businesses across Michigan in communities where median incomes are lower than the national average and poverty rates are higher.

“Northern Initiatives is uniquely positioned to collaborate with a variety of different organizations,” said Elissa Sangalli, President of Northern Initiatives. “We partner with the state, community foundations, and cities across the state.”

Partnering in WKKF’s Hometown: Battle Creek, Mich.

In surveys and community meetings as part of BCVision, the people of Battle Creek said that creating quality jobs and small business development were top priorities. New and growing businesses need access to capital, which is why the $10 million Battle Creek Small Business Loan Fund was established by the W.K. Kellogg Foundation in 2018. Managed by Northern Initiatives, with WKKF matching local investments 2:1, the Fund accelerates and supports economic development throughout Battle Creek.

To date, the Fund has supported 26 Battle Creek businesses through 38 small business loans worth nearly $4 million. With an average loan of $105,000, the work of the businesses varies – they include auto repair, food, health care, personal care businesses and more. 56% of the businesses are owned by women, while ownership by communities of color corresponds to the population of Battle Creek, according to Census data.

Related Links:

- Small business lending in Michigan promotes equity and spurs growth

- Supporting entrepreneurs of color boosts racial equity

- Promoting thriving families and equitable communities through small business lending in Battle Creek

- Solving transit barriers to improve employment opportunities

- Closing the racial wealth gap, one investment at a time

Comments