At this year’s SOCAP20 virtual conference, the W.K. Kellogg Foundation (WKKF) pulled together a group of panelists to talk about increasing power for workers—particularly low-income workers and workers of color.

In “Bridging the Equity Gap: Challenging the Skills Narrative,” panelists challenged the existing narrative about skills training and development, focused on the drivers of racial inequities and highlighted areas of investment that fundamentally change how workers of color are valued and supported.

In her opening, WKKF Program Officer Marissa Guananja talked about the skills gap, suggesting questions investors can ask about the company’s policies that support workers – particularly workers of color often at the lower end of the pay scale.

As investors, we must ask ourselves of the companies we invest:

- How are hiring decisions being made?

- What does compensation look like?

- What benefits do workers have access to or what benefits do they not have access to because of reduced labor costs by contracting that work?

- What kind of benefits are companies offering?

- What kind of benefits should we be considering as a public good?

To recapture that framing, we offer Guananja’s opening remarks:

When we were first approached about this panel, we thought about lifting up investment opportunities to address the skills gap. But we wanted to think more critically about what it’s going to take to address the racial inequities. Closing the skills gap is not nearly enough to close the racial income or wealth gaps that have been driving inequity in this country.

As a Latina woman— a Latina woman must work 22 months to be paid what a white man is paid in 12 months. I understand that this is not a skills gap problem. A report by the Washington Center for Equitable Growth shares striking data points on the racial and gender divides in the workplace. These divides are not driven by a skills gap problem.

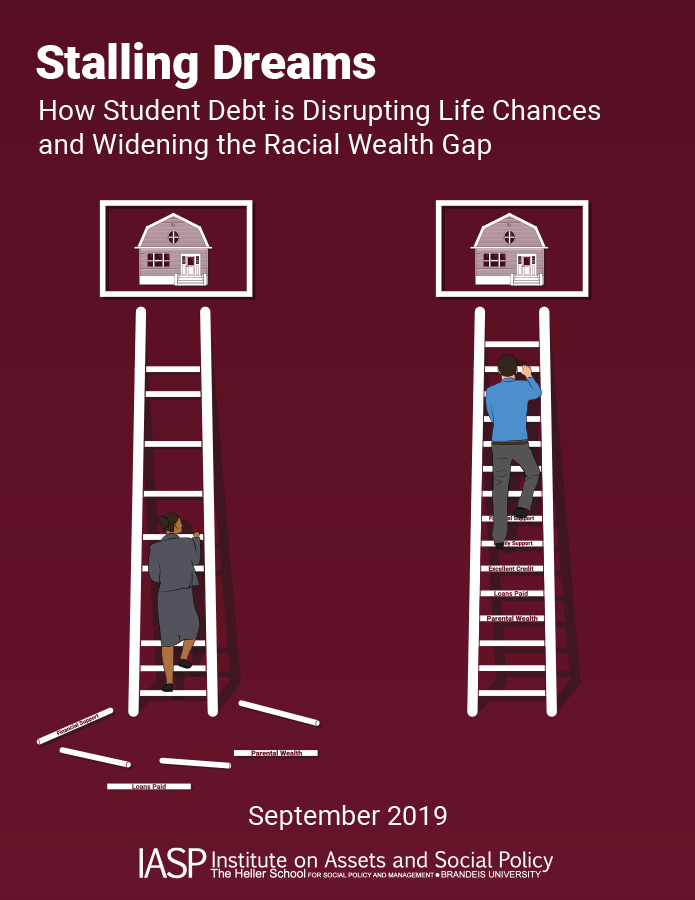

A few years ago, the Kellogg Foundation funded Brandeis University’s Institute of Assets and Social Policy to explore structural drivers of racial wealth inequity and I want to lift up two points from two different studies that came out of that project:

The first study, “Stalling Dreams: How Student Debt is Disrupting Life Chances and Widening the Racial Wealth Gap,” followed a cohort of students for 20 years, beginning in 1995. What they found: White students who had taken out student loans, had reduced their debt by 94% with almost half holding no student debt. Whereas the average Black borrower still owed 95% of their cumulative borrowing total. That is not a skills gap problem.

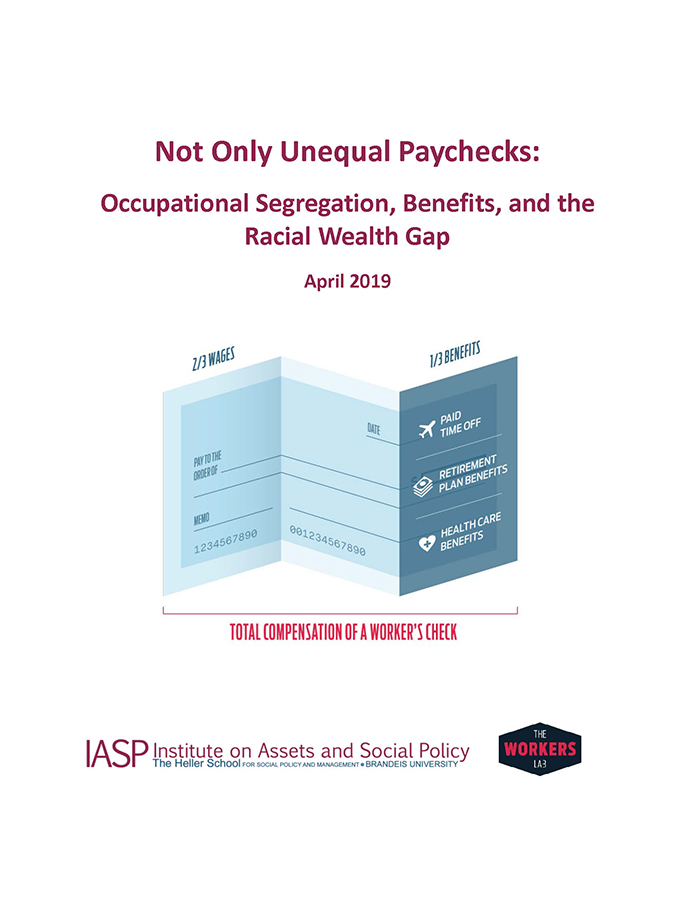

In “Not Only Unequal Paychecks: Occupational Segregation, Benefits, and the Racial Wealth Gap,” another report coming out of Brandeis University, we learned that roughly 1/3 of a person’s compensation comes from workplace benefits, e.g., healthcare, retirement, paid leave, education benefits. And yet, work has been restructured in a way that limits many Black and Brown workers’ access to those benefits. Many workers of color have been pushed into temporary work, gig work or contract work. And these are circumstances in which workplace benefits and protections are extremely limited, if present at all.

A 2017 New York Times article, “To Understand Rising Inequality, Consider the Janitors at Two Top Companies, Then and Now,” introduced two women: Marta Ramos, a janitor cleaning Apple headquarters today and Gail Evans, a janitor cleaning Kodak headquarters in the 1980s. The difference between the life opportunities that these two women had (and have) can be boiled down to the difference in their status as employees. Evans, at Kodak, had access to education benefits that allowed her to move up “the ladder.” Ramos, on the other hand, a contracted worker cleaning Apple headquarters 40+ hours per week has no access to the benefits that Apple provides its employees.

Yes, there is a skills gap. Yet, in order to have the impact we want, we as investors need to be thinking about downstream consequences of the investment choices that we make.

We need the business community –and the community here at SOCAP20—to be asking these questions and advocating for better workforce policies that affect systems level change so that families can be more financially and economically secure.

Comments