Transparency by the numbers

Don Williamson – Vice President of Finance & Treasurer

This post is also available in: Español (Spanish) Kreyòl (Haitian Creole)

Don Williamson – Vice President of Finance & Treasurer

The foundation operates on a fiscal year from September to August. This year’s snapshot reflects financial and grantmaking data starting Sept. 1, 2021, and ending Aug. 31, 2022.

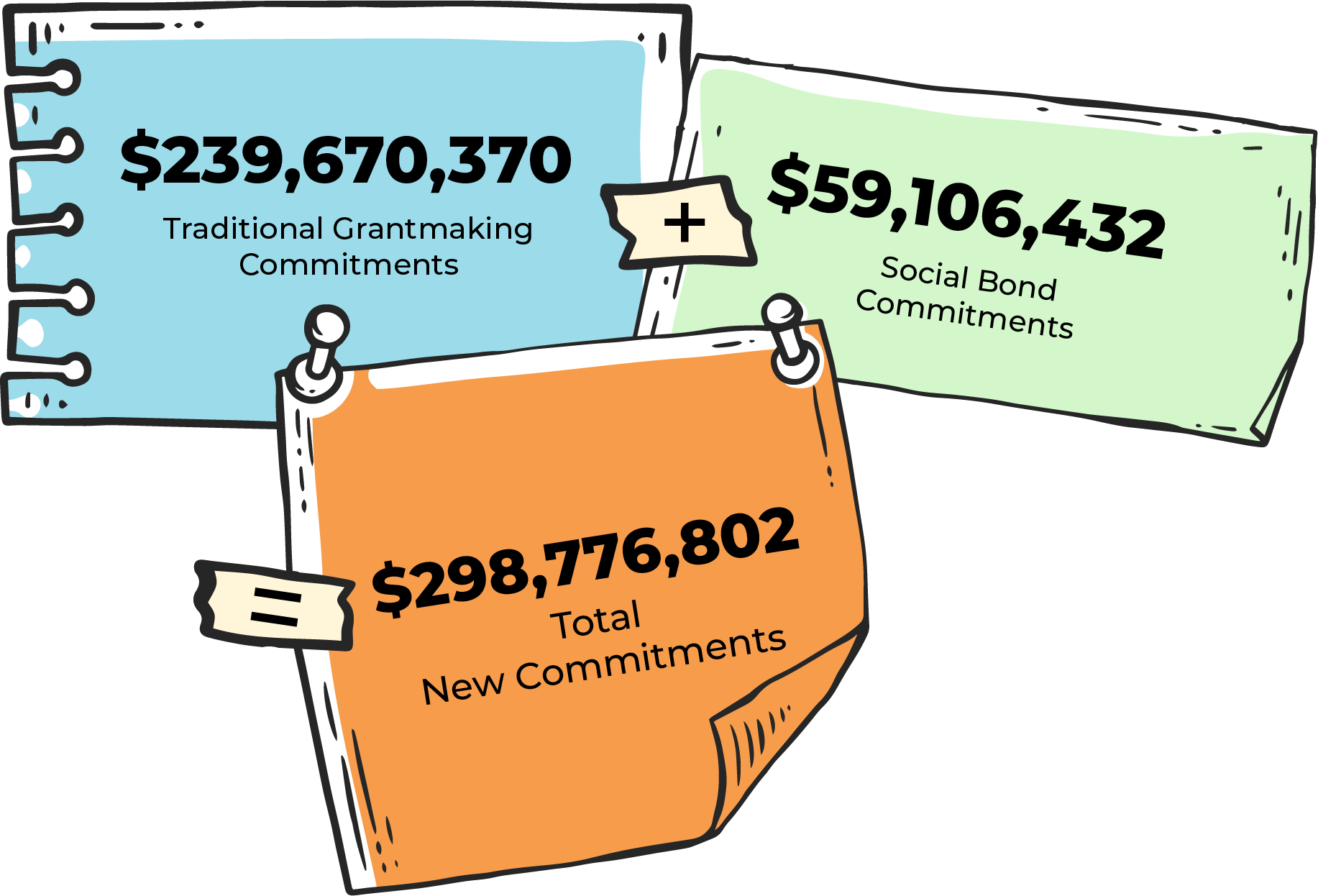

To respond to critical and urgent needs within our communities, the W.K. Kellogg Foundation Trust executed a historic transaction to successfully issue a $300 million social bond to increase our annual payout by 50%, or $150 million, in both the 2020/2021 and 2021/2022 fiscal years. This increased payout is in addition to our traditional distribution, with the goal of paying the social bond proceeds out fully by Dec. 31, 2022.

I am very pleased to report we met our goal and the full $300 million of the social bond was committed and paid out to grantees by the end of 2022 to support the foundation’s mission for thriving children, working families and equitable communities.

The sole purpose of the Trust investment portfolio is to raise funds through a successful investment strategy to fund the grantmaking and operations of the foundation. The foundation has an investment portfolio with both a mission driven element and a future growth focus. Our continued fiscal responsibility and focused management of market risk for both portfolios, including adjustments for the Trust’s core holding of Kellogg Company stock, remain central to our investment and financial planning strategy. As of Aug. 31, 2022, the investment portfolios for the foundation and Trust combined were valued at $8.67 billion, providing increased coverage for spending on grants, program-related activities, administration costs and inflation. Both the foundation and Trust portfolios continue to achieve benchmarks selected to track performance over market cycles to ensure meeting payout requirements and long-term growth.

The sole purpose of the Trust investment portfolio is to raise funds through a successful investment strategy to fund the grantmaking and operations of the foundation. The foundation has an investment portfolio with both a mission driven element and a future growth focus. Our continued fiscal responsibility and focused management of market risk for both portfolios, including adjustments for the Trust’s core holding of Kellogg Company stock, remain central to our investment and financial planning strategy. As of Aug. 31, 2022, the investment portfolios for the foundation and Trust combined were valued at $8.67 billion, providing increased coverage for spending on grants, program-related activities, administration costs and inflation. Both the foundation and Trust portfolios continue to achieve benchmarks selected to track performance over market cycles to ensure meeting payout requirements and long-term growth.

Our Mission Driven Investments portfolio, valued at $109.5 million of cash equivalents, fixed income and private equity, seeks to provide social impact in support of our mission, as well as achieve market-rate returns. Another tool the foundation uses to support grantmaking is program-related investments (PRIs), which are strategic investments that align with our mission and are typically below market-rate loans to organizations or charitable equity investments. As of Aug. 31, 2022, the foundation had $48.8 million in PRIs on its balance sheet, representing an approximately 30% increase over the prior year.

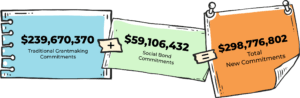

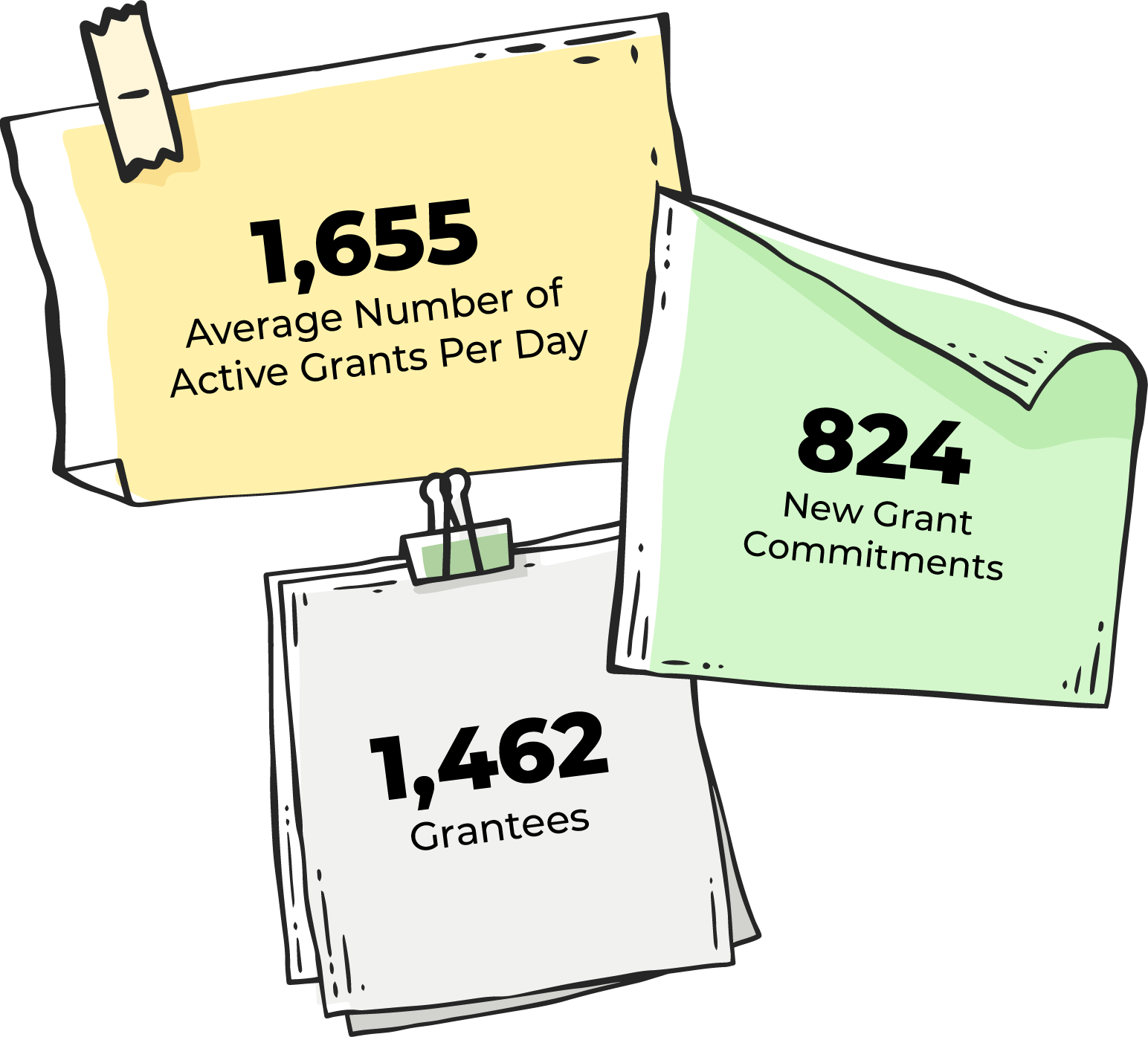

For the fiscal year, the foundation made new grant commitments totaling more than $298 million, which included distribution of the remaining social bond proceeds.

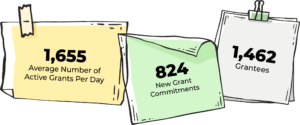

Of the foundation’s new commitments, nearly 59% benefited our priority places of Michigan, Mississippi, New Mexico and New Orleans in the United States, and internationally in central and southwest Haiti and in the highlands of Chiapas and the Yucatan Peninsula in Mexico. Additionally, new commitments were made across the U.S. nationally, as well as support for the five recipients of the Racial Equity 2030 global challenge.

The foundation’s trustees are provided bi-monthly treasurer’s reports which contain comparable financial statements, actual-to-budget information and progress toward achieving financial key performance indicators. Annually, the foundation leadership team prepares a programmatic and operational plan that realistically allocates our human capital and financial resources. The foundation’s comprehensive budget plan is presented to and accepted by our board.

Our annual independent accountants audit report is shared with and accepted by the full board. Mitchell Titus, LLP, serves as the independent accountant for the foundation and Trust. For tax technical expertise, advisory services and return filings, the foundation and Trust utilize Crowe, LLP.

A full set of the foundation and Trust’s audited financial statements are available for download, and the 990-PFs or anticipated filing dates are also available at wkkf.org.

The foundation operates on a fiscal year from September to August. This year’s snapshot reflects financial and grantmaking data starting Sept. 1, 2021, and ending Aug. 31, 2022.

To respond to critical and urgent needs within our communities, the W.K. Kellogg Foundation Trust executed a historic transaction to successfully issue a $300 million social bond to increase our annual payout by 50%, or $150 million, in both the 2020/2021 and 2021/2022 fiscal years. This increased payout is in addition to our traditional distribution, with the goal of paying the social bond proceeds out fully by Dec. 31, 2022.

I am very pleased to report we met our goal and the full $300 million of the social bond was committed and paid out to grantees by the end of 2022 to support the foundation’s mission for thriving children, working families and equitable communities.

The sole purpose of the Trust investment portfolio is to raise funds through a successful investment strategy to fund the grantmaking and operations of the foundation. The foundation has an investment portfolio with both a mission driven element and a future growth focus. Our continued fiscal responsibility and focused management of market risk for both portfolios, including adjustments for the Trust’s core holding of Kellogg Company stock, remain central to our investment and financial planning strategy. As of Aug. 31, 2022, the investment portfolios for the foundation and Trust combined were valued at $8.67 billion, providing increased coverage for spending on grants, program-related activities, administration costs and inflation. Both the foundation and Trust portfolios continue to achieve benchmarks selected to track performance over market cycles to ensure meeting payout requirements and long-term growth.

Our Mission Driven Investments portfolio, valued at $109.5 million of cash equivalents, fixed income and private equity, seeks to provide social impact in support of our mission, as well as achieve market-rate returns. Another tool the foundation uses to support grantmaking is program-related investments (PRIs), which are strategic investments that align with our mission and are typically below market-rate loans to organizations or charitable equity investments. As of Aug. 31, 2022, the foundation had $48.8 million in PRIs on its balance sheet, representing an approximately 30% increase over the prior year.

For the fiscal year, the foundation made new grant commitments totaling more than $298 million, which included distribution of the remaining social bond proceeds.

Of the foundation’s new commitments, nearly 59% benefited our priority places of Michigan, Mississippi, New Mexico and New Orleans in the United States, and internationally in central and southwest Haiti and in the highlands of Chiapas and the Yucatan Peninsula in Mexico. Additionally, new commitments were made across the U.S. nationally, as well as support for the five recipients of the Racial Equity 2030 global challenge.

The foundation’s trustees are provided bi-monthly treasurer’s reports which contain comparable financial statements, actual-to-budget information and progress toward achieving financial key performance indicators. Annually, the foundation leadership team prepares a programmatic and operational plan that realistically allocates our human capital and financial resources. The foundation’s comprehensive budget plan is presented to and accepted by our board.

Our annual independent accountants audit report is shared with and accepted by the full board. Mitchell Titus, LLP, serves as the independent accountant for the foundation and Trust. For tax technical expertise, advisory services and return filings, the foundation and Trust utilize Crowe, LLP.

A full set of the foundation and Trust’s audited financial statements are available for download, and the 990-PFs or anticipated filing dates are also available at wkkf.org.