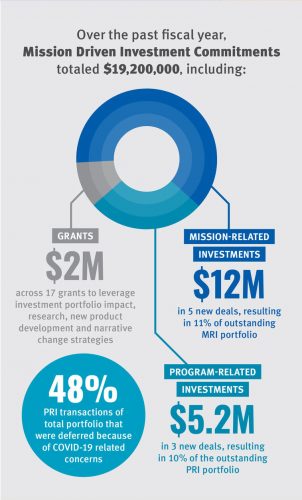

Over the past fiscal year, Mission Driven Investment (MDI) commitments totaled $19.2M, including:

- MRI: $12M in five new deals, resulting in 11% of total MRI portfolio

- PRI: $5.2M in three new deals, resulting in 10% of the total PRI portfolio

- Grants: $2M across 17 grants to leverage investment portfolio impact

- COVID-19 related deferrals: 10 (of 21) PRI deals comprising 50% of PRI funds

Our MDI team uses both below market-rate and market-rate investments – effectively putting more money to work in communities and growing the range of opportunities available to investors looking for ways to fuel meaningful change.

WKKF’s distinctive approach started in 2007, when trustees committed $100 million of the endowment to mission-related investments (MRIs) and additional fund to market rate program-related investments (PRIs).

Predominately a private markets strategy, the Kellogg Foundation only invests these resources with fund managers and enterprises that directly advance our priorities – thriving children, working families, equitable communities.

MDI investments come in all shapes and sizes — both nonprofit and for-profit entities and across a range of asset classes, including real estate, private equity, fixed income, debt and cash deposits. Investments also support fund managers, entrepreneurs and social enterprises to launch and scale innovative products and services. In all instances, MDI resources are committed to directly advance WKKF’s mission, with an emphasis on investments that help to dismantle the root causes of racial inequity.

Comments