Increasingly, families in the U.S. are struggling to meet rising costs and help their children thrive.

Household costs, as measured by the Consumer Price Index, have risen 66% over the last two decades, but wages and income, adjusted for inflation, have grown only 2% during the same time.

Since 1969, the federal government has used the Official Poverty Measure (OPM) to estimate what families need to cover household expenses. In the years since its conception, the federal government has not changed the OPM methodology; however, other measures such as the Supplemental Poverty Measure were introduced and used to capture other basic household costs to help assess what people need to meet their primary needs. While crucial in helping paint a clearer picture of what families need to survive, they don’t go far enough in helping us see what families — particularly those with children— need to thrive. By continuing to use limited measures of cost, the scale of true economic need is hidden and policy responses are inadequate We need new analyses that help us better understand what families need.

To address this gap, W.K. Kellogg Foundation (WKKF) grantee Federation of Protestant Welfare Agencies (FPWA) commissioned the Urban Institute to develop a comprehensive new measure that holds great promise to sharpen our understanding of what families need and which federal, state and local policies can help most.

The first national True Cost of Economic Security Measure (TCES) defines economic security as when households have enough resources to pay for all the goods and services necessary to fully participate in today’s economy and society, as well as save money for emergencies and the future. The new measure is innovative because it is based on economic security, not acute deprivation, and incorporates costs not included in typical measures of economic well-being in the U.S.

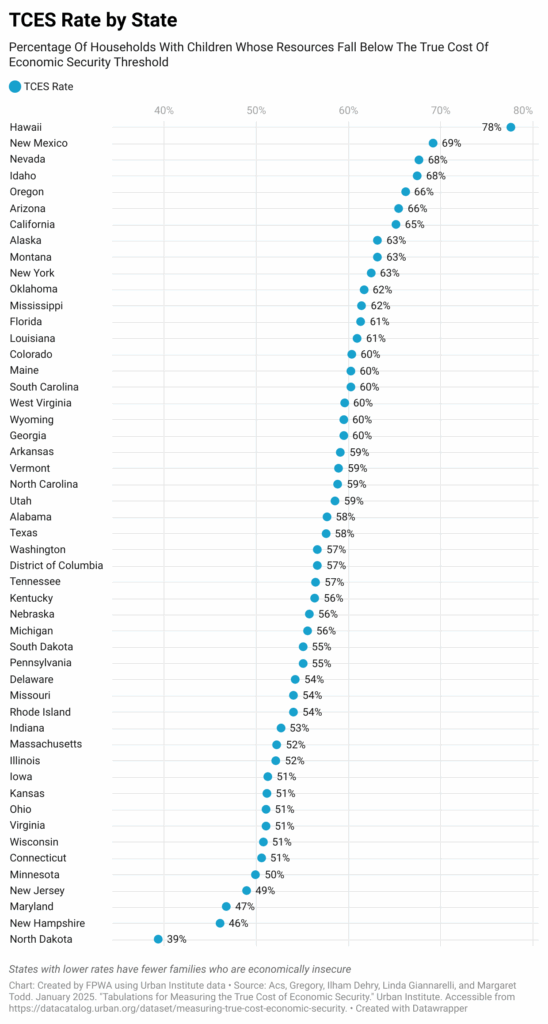

According to costs and resources data compiled for nearly every county in the United States, the innovative measure reveals that more than half of Americans are not economically secure. Even fully employed households could be one accident or job loss away from economic ruin. And even if they’re able to meet most regular expenses, many are unable to save for the future. Other key findings include:

2/3

children under 18 live in families with resources falling below the TCES threshold.

1/2

of all families with two adults under age 65 and two children lack the resources to cover their costs.

80%+

of people in single-parent families fall below the TCES threshold.

43M

children are being raised in households that can’t consistently save money each month.

TCES is now being used by policymakers and influencers to inform and shape public discourse and policymaking at all levels of government. Over time, the accumulation and use of more TCES data will help drive systems change for the benefit of children and families across the country.

To learn more about the findings – and how it impacts children and families – join FPWA and WKKF for a virtual webinar called “The True Cost of Economic Security: Measuring What it Takes for Children to Thrive.” on September 16 at 1pmET. Visit nationaltruecostofliving.org to learn more.

Comments