BY THE NUMBERS

With the August 31, 2021 fiscal year-end close, we continue to see the overwhelming challenges experienced by our grantees and communities caused by the pandemic. To respond to urgent requests for support, the W.K. Kellogg Foundation Trust successfully issued a $300 million social bond in October 2020 to increase our annual payout by 50%, or $150 million, in both the 2020/2021 and 2021/2022 fiscal years. This increased payout is in addition to our traditional distribution, with the goal of paying the social bond proceeds out fully by Aug. 31, 2022.

Meeting the needs of our communities.

Aligned with our priorities – thriving children, working families, equitable communities – and our DNA (community engagement, leadership and racial equity), expanded payout funds were provided for:- Innovations in quality early childhood education, employment or economic equity and health equity

- Philanthropic partnerships for community rebuilding and reimagining post COVID-19

- Supporting people of color-serving institutions or leadership

- Racial equity and racial healing, including narrative change

- Policy advocacy and systems change

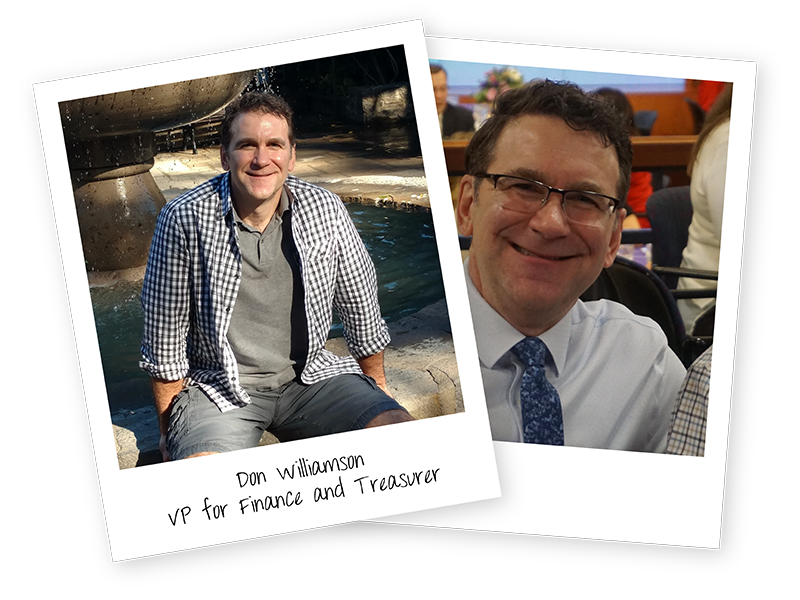

I am very pleased to report that as of Aug. 31, 2021, $232 million of the $300 million has been committed to support our mission for thriving children, working families and equitable communities. Our continued fiscal responsibility and focused management of market risk, including adjustments for our core holding of Kellogg Company stock, remain central to our investment and financial planning strategy. The investment portfolios for the foundation and Trust combined were valued at $8.6 billion, providing increased coverage for spending on grants, program-related activities, administration costs and inflation.

Our Mission Driven Investments portfolio, valued at $107.2 million of cash equivalents, fixed income and private equity, seeks to provide social impact in support of our mission, as well as achieve market-rate returns. Another tool the foundation uses to support grantmaking is program-related investments (PRIs), which are strategic investments that align with our mission and are typically below market-rate loans to organizations or charitable equity investments. As of Aug. 31, 2021, the foundation had $37.7 million in PRIs on its balance sheet.

For the fiscal year, the foundation made new grant commitments totaling more than $483 million, which is a significant 91% increase over our prior fiscal year.

Of this total, nearly 55% benefited WKKF’s priority places of Michigan, Mississippi, New Mexico and New Orleans in the United States, and internationally in central and southwest Haiti and in the highlands of Chiapas and the Yucatan Peninsula in Mexico.

The foundation’s trustees are provided bimonthly financial statements and reports on achieving key performance indicators. Annual fiscal operating plans prepared by management are reviewed and accepted by our board. Results of the examinations by independent accountants and the foundation’s internal audit office are reviewed and accepted by the full board. Mitchell Titus, LLP serves as the independent accountant for the foundation and the Trust. For tax technical expertise, advisory services and return filings, the foundation and Trust utilize Crowe LLP.

The W.K. Kellogg Foundation’s and W.K. Kellogg Foundation Trust’s financial statements are audited by Mitchell Titus, LLP. A full set of the 2021 audited financial statements is available for download, and the 990-PFs are also available at wkkf.org.